To buy, or not to buy? That is the question asked by so many condo renters (and their parents) with the release of every new data point on Toronto's real estate market.

The answer, as it turns out, can vary a lot based on where in the city you live.

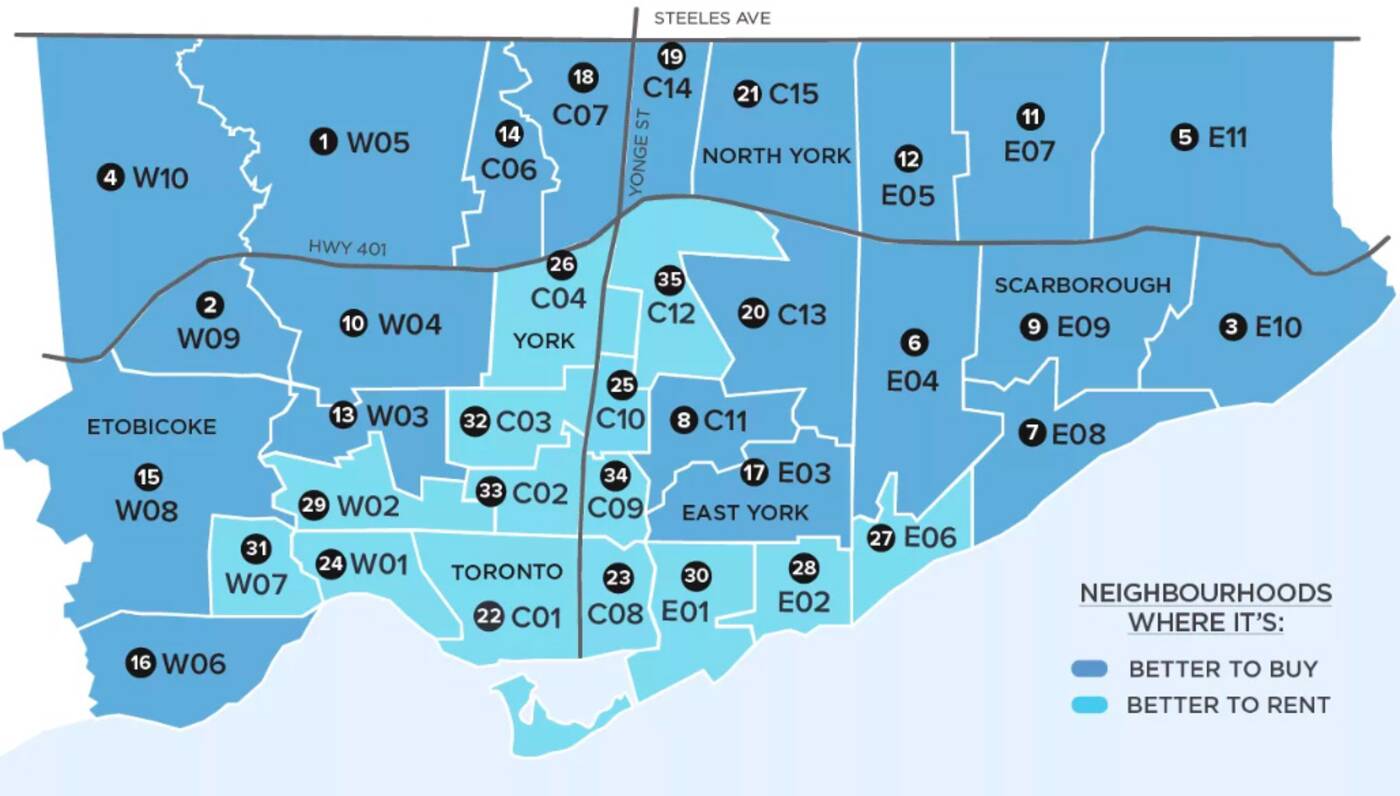

A new report from the real estate brokerage Zoocasa shows that in 21 of the 35 City of Toronto neighbourhoods, paying rent is actually more expensive than paying off a mortgage, on a monthly cash outflow basis.

"Does it make more financial sense to rent or buy your home? The pros and cons of either scenario have long been debated by money pundits," reads the report, which was released on Thursday.

"It was once considered savvy for savers to invest their down payment sums as an alternative to homeownership," it continues.

"But that approach harks back to a time when renting in Toronto was still a feasibly affordable alternative; today, the average 416 rental apartment commands $2,417 per month, according to the Toronto Real Estate Board’s Q2 rental report."

Unsurprisingly, it still costs more to buy a condo than rent one in most of downtown Toronto. Image via Zoocasa.

Unsurprisingly, it still costs more to buy a condo than rent one in most of downtown Toronto. Image via Zoocasa.

Zoocasa estimates that rent now consumes 73.3 percent of a person's paycheque in Toronto — but that's based on someone earning the city's median single income of $39,560. Many people who rent $2,500 condos make considerably more money than this, and often split the rent with a partner or roommate.

Still, financial experts say that housing costs should account for no more than 30 percent of an individual's income — which, according to Zoocasa, makes buying a more viable option in Toronto right now for some people.

The brokerage looked at the average monthly rent and average condo price in each 416 MLS district, breaking down the latter figure by month with the assumption of a 20 per cent down payment and 3.05 percent 25 year mortgage.

What wasn't factored in were monthly condo fees, insurance or utilities — so take the figures below with a grain of salt.

The top 5 neighbourhoods where paying a mortgage is less than paying rent, according to Zoocasa:

- Black Creek, York University Heights - buying saves $606/month (average rent: $1,939, average mortgage: $1,333)

- Willowridge, Martingrove - buying saves $600/month (average rent: $2,107, average mortgage: $1,507)

- West Hill, Centennial Scarborough - buying saves $576/month (average rent: $1,650, average mortgage: $1,074)

- Rexdale-Kipling - buying saves $551/month (average rent: $1,834, average mortgage: $1,283)

- Malvern, Rouge - buying saves $490/month (average rent: $1,751, average mortgage: $1,261)

View the full list of neighbourhoods and how they stack up here.

by Lauren O'Neil via blogTO

Looking for condo in Toronto? Get the Best Flats, Apartments and Condos in Canada.

ReplyDelete